An unusual study of traders spit may offer a taste of the future in how we understand what drives markets -- and why they arent as stable and efficient as we might hope.

An unusual study of traders spit may offer a taste of the future in how we understand what drives markets -- and why they arent as stable and efficient as we might hope.

Several years ago, two neuroscientists undertook an experiment on the trading floor of a major investment bank in London. Over eight consecutive business days, at both 11 a.m. and 4 p.m., John Coates and Joe Herbert took samples of saliva from the mouths of 17 traders. With these samples, taken before and after the bulk of the days trading activity, they measured the rising and falling levels of a number of steroid hormones, including testosterone, adrenaline and cortisol.

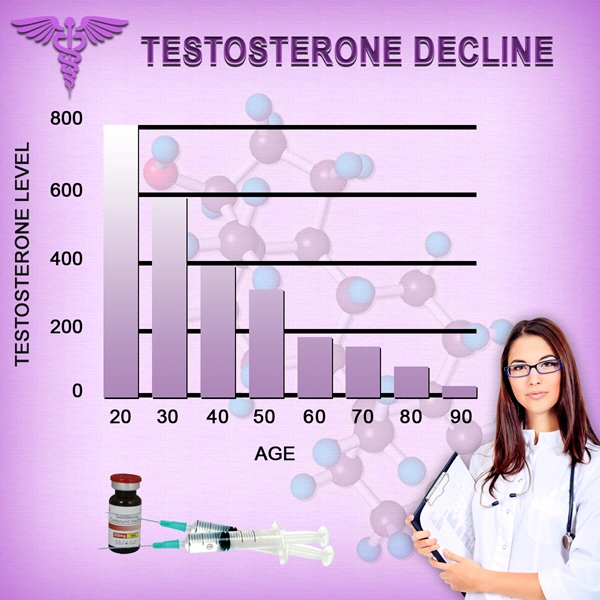

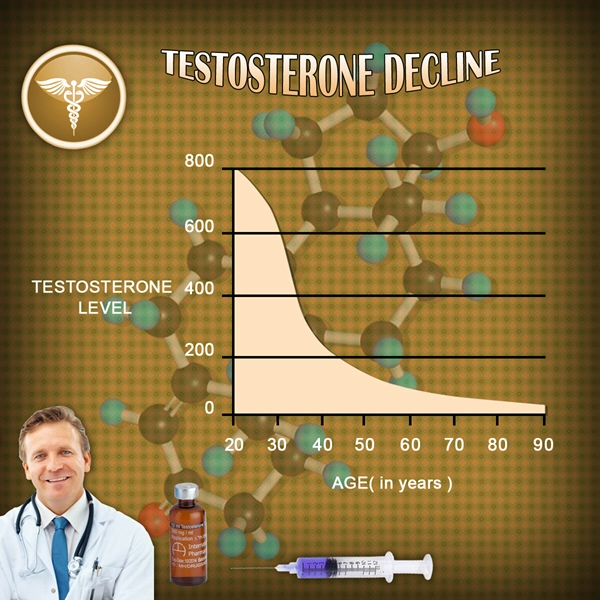

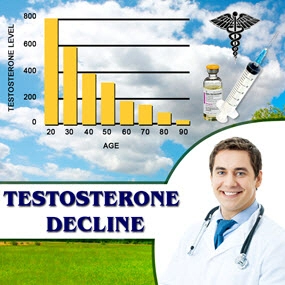

The data revealed physiological changes not evident to the eye. To begin with, Coates and Herbert found that when traders did well and made money, they didnt do it solely through cleverness and cerebral dexterity. Guts also played a role, although testicles would actually be more accurate. Traders performed better on days in which they registered higher morning levels of the hormone testosterone, which is mostly produced in the testes.

This isnt actually surprising. After all, testosterone increases the level of hemoglobin in the blood, enabling it to carry more oxygen. Experiments in both animals and humans show that it boosts searching persistence, fearlessness and appetite for risk, qualities that obviously help any trader exploit real opportunities in the market. Athletes preparing for a competition produce more testosterone, which helps bring them to an optimal state of readiness for intense action.

The London experiments, though, also showed something unexpected. Levels of the hormone cortisol -- often called the stress hormone, because its levels rise in people experiencing severe psychological or physical stress -- didnt increase when traders suffered significant losses. Rather, they went up in direct proportion to the volatility of recent trading. The more wildly unpredictable the record of wins and losses, the more cortisol. In sufficient quantities, the hormone orchestrates a response to injury or threat by shutting down functions related to digestion and reproduction, even the immune system.

This simple fact should have big implications for how we think about markets. Market participants arent the rational automatons of most financial theory. They are biological organisms responding with a neural and physiological apparatus designed millions of years ago. If what happens in markets affects hormones, these in turn alter behavior and feed back into the markets. As Coates argues in a new book, our bodies may make us hard-wired for episodes of financial boom and bust.

Biologists studying animals in the wild have documented a testosterone-driven dynamic called the winner effect. If two male lions or bears fight over a potential mate, the level of testosterone in the winner skyrockets afterward, while that of the loser plummets. This makes evolutionary sense, as the loser needs to rest and put energy into recovery, while the winner often faces immediate challenges from other rivals.

Ultimately, the winner effect can lead to trouble. By boosting confidence and risk appetite, testosterone priming makes that winner more likely to win again, and successive winning can push testosterone to counterproductive levels. Indeed, researchers have observed a systematic tendency for animals to become so aggressive and overconfident after a period of serial winning that they take stupid risks -- standing in open ground, for example, where they can be seen and attacked by several rivals together.

In light of these findings, its natural to suspect that a good part of the giddy energy and aggressive excitement that spills over Wall Street during a long bull market must reflect a surge in general testosterone levels, and that basic physiological mechanisms can drive financial bubbles. The more markets rise, the more confident and risk-seeking traders and investors become. The ultimate outcome is a market of people largely convinced of their own invincibility and ready to take irrational risks confident in the outcome being yet another victory.

Contact Us Today For A Free Consultation

- Adverse Effects of Testosterone Therapy in Adult Men: A Systematic Review and Meta-Analysis [Last Updated On: July 2nd, 2024] [Originally Added On: June 4th, 2010]

- Low Testosterone Levels, Foods That Increase Testosterone Levels wwwSelf-Improvement-Bible.com [Last Updated On: November 12th, 2023] [Originally Added On: May 30th, 2011]

- Low Testosterone in Men: The Next Big Thing in Medicine! - Abraham Morgentaler, MD [Last Updated On: May 7th, 2023] [Originally Added On: June 3rd, 2011]

- How To Determine Testosterone Levels By Looking At Your Ring Finger [Last Updated On: December 7th, 2017] [Originally Added On: June 30th, 2011]

- Prolab Horny Goat Weed Testosterone Booster Supplement Review [Last Updated On: November 23rd, 2023] [Originally Added On: July 19th, 2011]

- The Healthy Skeptic: Products make testosterone claims [Last Updated On: August 13th, 2024] [Originally Added On: September 11th, 2011]

- How To Naturally Increase Testosterone [Last Updated On: November 21st, 2023] [Originally Added On: September 28th, 2011]

- Testosterone Production - Video [Last Updated On: November 25th, 2024] [Originally Added On: November 20th, 2011]

- Testosterone makes us less cooperative and more egocentric, study finds [Last Updated On: January 23rd, 2018] [Originally Added On: February 1st, 2012]

- Testosterone makes us less cooperative and more egocentric [Last Updated On: January 24th, 2018] [Originally Added On: February 1st, 2012]

- Too much testosterone makes for bad decisions, tests show [Last Updated On: May 4th, 2015] [Originally Added On: February 1st, 2012]

- Today in Research: Testosterone's Negative Effects; Diet Soda Death [Last Updated On: January 2nd, 2018] [Originally Added On: February 2nd, 2012]

- Testosterone drives ego, trips cooperation [Last Updated On: December 2nd, 2017] [Originally Added On: February 4th, 2012]

- FDA approves BioSante/Teva's testosterone gel [Last Updated On: May 4th, 2015] [Originally Added On: February 15th, 2012]

- 'Manly' Fingers Make For Strong Jawline in Young Boys [Last Updated On: December 1st, 2017] [Originally Added On: February 15th, 2012]

- Teva, BioSante Win U.S. Approval for Testosterone Therapy [Last Updated On: December 10th, 2017] [Originally Added On: February 15th, 2012]

- BioSante Gains on Approval of Testosterone Gel: Chicago Mover [Last Updated On: January 8th, 2018] [Originally Added On: February 16th, 2012]

- BioSante soars following drug approval from FDA [Last Updated On: December 26th, 2017] [Originally Added On: February 16th, 2012]

- Antibodies, Not Hard Bodies: The Real Reason Women Drool Over Brad Pitt [Last Updated On: December 24th, 2017] [Originally Added On: February 21st, 2012]

- Almark Publishing Releases Book From Mark Rosenberg, M.D. Revealing Natural Discoveries Associated With Low ... [Last Updated On: May 4th, 2015] [Originally Added On: February 28th, 2012]

- Testosterone Replacement Clinic Comes to Kansas City with Potential to Help Thousands of Men [Last Updated On: May 4th, 2015] [Originally Added On: March 1st, 2012]

- Study examines the relative roles of testosterone and its metabolite, dihydrotestosterone in men [Last Updated On: December 2nd, 2017] [Originally Added On: March 7th, 2012]

- The Role of 5{alpha}-Reductase Inhibition in Men Receiving Testosterone Replacement Therapy [Editorial] [Last Updated On: December 21st, 2017] [Originally Added On: March 7th, 2012]

- Effect of Testosterone Supplementation With and Without a Dual 5{alpha}-Reductase Inhibitor on Fat-Free Mass in Men ... [Last Updated On: January 3rd, 2018] [Originally Added On: March 7th, 2012]

- Why We Like Men Who Can Keep Their Cool [Last Updated On: December 30th, 2017] [Originally Added On: March 7th, 2012]

- Testosterone And Heart Health [Last Updated On: May 4th, 2015] [Originally Added On: March 10th, 2012]

- Your Life on Testosterone: Overly Sure of Yourself, Unwilling to Listen [Last Updated On: November 25th, 2018] [Originally Added On: March 15th, 2012]

- Mayo Clinic-TGen study role testosterone may play in triple negative breast cancer [Last Updated On: December 8th, 2017] [Originally Added On: March 23rd, 2012]

- A dose of testosterone might not cure what ails you [Last Updated On: January 23rd, 2018] [Originally Added On: March 25th, 2012]

- Green tea could aid athletes hide testosterone doping [Last Updated On: December 16th, 2017] [Originally Added On: March 25th, 2012]

- TGen Study Role Testosterone May Play in Triple Negative Breast Cancer [Last Updated On: December 6th, 2017] [Originally Added On: March 26th, 2012]

- Testosterone low, but responsive to competition, in Amazonian tribe [Last Updated On: January 23rd, 2018] [Originally Added On: March 28th, 2012]

- Competition-linked bursts of testosterone are fundamental aspect of human biology, study of Amazonian tribe suggests [Last Updated On: December 25th, 2017] [Originally Added On: March 28th, 2012]

- Playing football boosts testosterone levels by 30 percent! [Last Updated On: February 4th, 2024] [Originally Added On: March 28th, 2012]

- Testosterone low, but responsive to competition, in Amazonian tribe -- with slideshow [Last Updated On: December 9th, 2017] [Originally Added On: March 28th, 2012]

- The benefits of testosterone pellet therapy [Last Updated On: January 24th, 2018] [Originally Added On: March 29th, 2012]

- Low testosterone levels cause health woes [Last Updated On: November 25th, 2018] [Originally Added On: March 30th, 2012]

- Heart Failure Patients Getting Relief from Testosterone Supplements [Last Updated On: May 4th, 2015] [Originally Added On: April 21st, 2012]

- Study Finds Fatherhood Suppresses Testosterone [Last Updated On: May 4th, 2015] [Originally Added On: May 3rd, 2012]

- Low testosterone levels could raise diabetes risk for men [Last Updated On: January 26th, 2018] [Originally Added On: May 5th, 2012]

- Why low testosterone may increase your risk of diabetes [Last Updated On: November 25th, 2024] [Originally Added On: May 5th, 2012]

- Diabetes link to low testosterone [Last Updated On: November 25th, 2024] [Originally Added On: May 5th, 2012]

- Testosterone Linked to Weight Loss in Obese Men [Last Updated On: January 2nd, 2018] [Originally Added On: May 11th, 2012]

- Testosterone may help weight loss [Last Updated On: November 25th, 2024] [Originally Added On: May 11th, 2012]

- Testosterone-fuelled infantile males might be a product of Mom's behaviour [Last Updated On: December 25th, 2017] [Originally Added On: May 11th, 2012]

- Testosterone-fueled infantile males might be a product of Mom's behavior [Last Updated On: January 6th, 2018] [Originally Added On: May 11th, 2012]

- Testosterone supplements may help obese men lose weight [Last Updated On: January 5th, 2018] [Originally Added On: May 11th, 2012]

- Testosterone supplements 'can help men lose their middle-aged spread' [Last Updated On: November 25th, 2024] [Originally Added On: May 12th, 2012]

- Some doctors question safety of testosterone replacement therapy [Last Updated On: January 20th, 2018] [Originally Added On: May 15th, 2012]

- Health Canada Approves New Testosterone Topical Solution for Men [Last Updated On: May 4th, 2015] [Originally Added On: May 15th, 2012]

- Environment trumps genes in testosterone levels, study finds [Last Updated On: May 4th, 2015] [Originally Added On: May 15th, 2012]

- Global Testosterone Replacement Therapy (TRT) Industry [Last Updated On: May 4th, 2015] [Originally Added On: May 21st, 2012]

- Testosterone Fuels Boom, Swindler Sows Panic: Top Business Books [Last Updated On: January 13th, 2018] [Originally Added On: June 2nd, 2012]

- Increase in testosterone drug use [Last Updated On: April 12th, 2018] [Originally Added On: June 4th, 2012]

- Testosterone Promotes Agression Automatically [Last Updated On: January 29th, 2018] [Originally Added On: June 9th, 2012]

- Testosterone shown to help sexually frustrated women [Last Updated On: January 27th, 2018] [Originally Added On: June 9th, 2012]

- Research and Markets: Testosterone Replacement Therapy (TRT) - Global Strategic Business Report [Last Updated On: December 23rd, 2017] [Originally Added On: June 12th, 2012]

- Proposed testosterone testing of some female olympians challenged by Stanford scientists [Last Updated On: January 30th, 2018] [Originally Added On: June 14th, 2012]

- Testosterone Makes Bosses Into Jerks, Says Paul Zak [Last Updated On: January 8th, 2018] [Originally Added On: June 14th, 2012]

- Testosterone Therapy: A Misguided Approach to Erectile Dysfunction (ED) [Last Updated On: May 4th, 2015] [Originally Added On: June 20th, 2012]

- New drugs, new ways to target androgens in prostate cancer therapy [Last Updated On: January 8th, 2018] [Originally Added On: June 20th, 2012]

- Long-term testosterone treatment for men results in reduced weight and waist size [Last Updated On: January 19th, 2018] [Originally Added On: June 23rd, 2012]

- Declining testosterone levels in men not part of normal aging, study finds [Last Updated On: December 27th, 2017] [Originally Added On: June 23rd, 2012]

- Low testosterone not normal part of aging [Last Updated On: December 22nd, 2017] [Originally Added On: June 25th, 2012]

- Testosterone Does Not Necessarily Wane With Age [Last Updated On: December 6th, 2017] [Originally Added On: June 25th, 2012]

- Overweight men can boost low testosterone levels by losing weight [Last Updated On: December 10th, 2017] [Originally Added On: June 25th, 2012]

- Testosterone-replacement therapy improves symptoms of metabolic syndrome [Last Updated On: January 14th, 2018] [Originally Added On: June 26th, 2012]

- Testosterone therapy takes off pounds [Last Updated On: December 11th, 2017] [Originally Added On: June 26th, 2012]

- Weight loss may boost men's testosterone [Last Updated On: May 4th, 2015] [Originally Added On: June 27th, 2012]

- Low Testosterone? Study finds age may not be to blame [Last Updated On: May 4th, 2015] [Originally Added On: July 1st, 2012]

- Do you have low testosterone? [Last Updated On: December 15th, 2017] [Originally Added On: July 8th, 2012]

- Wall Streeters Buying Testosterone for an Edge [Last Updated On: May 4th, 2015] [Originally Added On: July 12th, 2012]

- Beefy Wall Street Traders rub on testosterone [Last Updated On: February 20th, 2024] [Originally Added On: July 12th, 2012]

- Tale of two runners exposes flawed Olympic thinking [Last Updated On: December 23rd, 2024] [Originally Added On: July 19th, 2012]

- Genetic markers for testosterone and estrogen level regulation identified [Last Updated On: January 6th, 2018] [Originally Added On: July 20th, 2012]

- BUSM researchers identify genetic markers for testosterone, estrogen level regulation [Last Updated On: December 18th, 2017] [Originally Added On: July 20th, 2012]

- DRS. OZ AND ROIZEN: How to reap the benefits of normal testosterone levels [Last Updated On: December 23rd, 2024] [Originally Added On: July 21st, 2012]

- How Testosterone Drives History [Last Updated On: December 24th, 2024] [Originally Added On: July 22nd, 2012]

- Testosterone replacement is "fountain of youth" for men [Last Updated On: January 3rd, 2018] [Originally Added On: July 27th, 2012]

- Pill for low testosterone in men heads for phase II clinical trials [Last Updated On: December 31st, 2017] [Originally Added On: August 2nd, 2012]

Word Count: 654