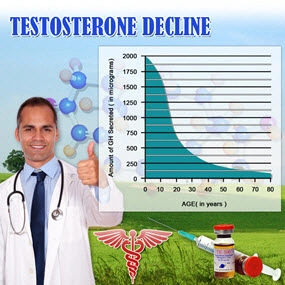

Introduction to Late-Onset Hypogonadism

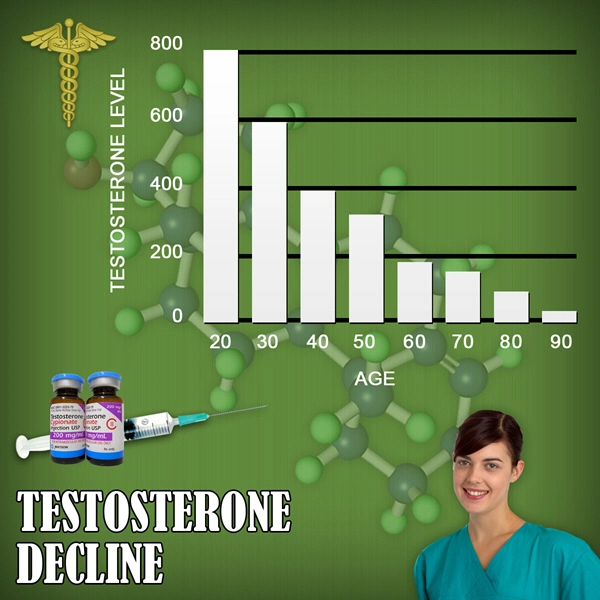

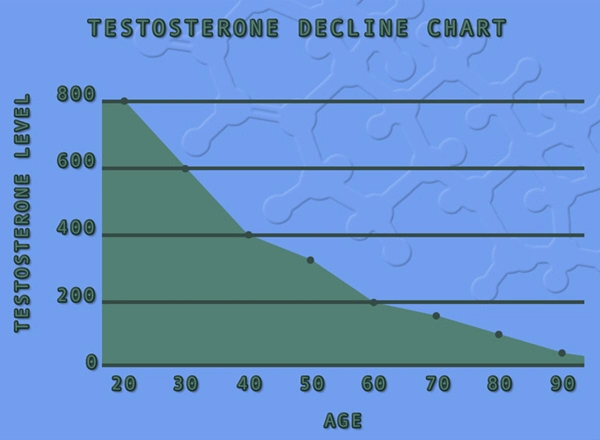

Late-onset hypogonadism (LOH), also known as age-related low testosterone, is a clinical and biochemical syndrome characterized by a deficiency in serum testosterone levels in conjunction with specific signs and symptoms. As men age, testosterone levels naturally decline, which can lead to a variety of symptoms including decreased libido, erectile dysfunction, fatigue, and mood disturbances. For American men, understanding how to navigate insurance coverage for the diagnosis and treatment of LOH is crucial for managing this condition effectively.

The Importance of Diagnosis

Before delving into insurance coverage, it's essential to emphasize the importance of a proper diagnosis. LOH can be confirmed through a combination of clinical symptoms and laboratory tests measuring serum testosterone levels. It's recommended that men experiencing symptoms consult with a healthcare provider who can conduct a thorough evaluation. This step is not only vital for health reasons but also because insurance companies often require a confirmed diagnosis before approving coverage for treatments.

Navigating Insurance Coverage for Diagnosis

Most health insurance plans in the United States cover the costs associated with diagnosing LOH, including blood tests and consultations with healthcare providers. However, it's important for men to review their specific insurance policy to understand any out-of-pocket costs they might incur. Some plans may require a referral from a primary care physician before covering specialist consultations, so it's advisable to check these details in advance.

Treatment Options and Insurance Coverage

Once diagnosed, treatment for LOH typically involves testosterone replacement therapy (TRT). This can be administered through various methods, including injections, gels, patches, or pellets. The coverage of TRT by insurance varies significantly depending on the provider and the specific plan. Some insurance companies may cover the full cost of TRT, while others might require copayments or have restrictions on the type of therapy covered.

To navigate this, men should:

1. **Review Their Policy**: Understand the specifics of what is covered under their health plan, including any limitations or exclusions related to TRT.

2. **Appeal Denials**: If an insurance claim for TRT is denied, men have the right to appeal the decision. This process involves submitting additional medical documentation to support the necessity of the treatment.

3. **Explore Alternative Coverage**: For those whose insurance does not cover TRT, exploring alternative coverage options such as supplemental health plans or patient assistance programs offered by pharmaceutical companies can be beneficial.

The Role of Healthcare Providers

Healthcare providers play a pivotal role in helping men navigate insurance coverage for LOH. They can assist by providing detailed medical documentation that supports the diagnosis and necessity of TRT, which is crucial for insurance approval. Additionally, healthcare providers can guide patients through the appeals process if initial claims are denied.

Lifestyle and Preventive Measures

While insurance coverage is a critical aspect of managing LOH, men should also consider lifestyle modifications that can help mitigate symptoms. Regular exercise, a balanced diet, adequate sleep, and stress management can all contribute to overall well-being and may help alleviate some symptoms of LOH. These measures can also be beneficial in maintaining overall health, which is important for men as they age.

Conclusion

Navigating insurance coverage for late-onset hypogonadism can be challenging, but with the right information and support, American men can effectively manage this condition. By understanding their insurance policies, working closely with healthcare providers, and considering lifestyle adjustments, men can take proactive steps towards improving their quality of life. As awareness and understanding of LOH continue to grow, it's hoped that insurance coverage will become more accessible and straightforward for those affected by this condition.

Contact Us Today For A Free Consultation

- Exploring Alternatives to TRT for Late-Onset Hypogonadism in American Males [Last Updated On: March 9th, 2025] [Originally Added On: March 9th, 2025]

- Nutrition's Role in Managing Late-Onset Hypogonadism in American Males [Last Updated On: March 17th, 2025] [Originally Added On: March 17th, 2025]

- Future of Late-Onset Hypogonadism Treatment: Innovations and Personalized Approaches [Last Updated On: March 17th, 2025] [Originally Added On: March 17th, 2025]

- Late-Onset Hypogonadism: Impact on Mood, Energy, and Quality of Life in American Men [Last Updated On: March 17th, 2025] [Originally Added On: March 17th, 2025]

- Genetic Insights into Late-Onset Hypogonadism in Aging American Males [Last Updated On: March 20th, 2025] [Originally Added On: March 20th, 2025]

- Late-Onset Hypogonadism: Effects on Muscle Mass and Treatment Options in American Men [Last Updated On: March 20th, 2025] [Originally Added On: March 20th, 2025]

- Late-Onset Hypogonadism: Prevalence, Economic Impact, and Management Challenges in American Men [Last Updated On: March 20th, 2025] [Originally Added On: March 20th, 2025]

- Late-Onset Hypogonadism: Symptoms, Diagnosis, and Management in American Males [Last Updated On: March 21st, 2025] [Originally Added On: March 21st, 2025]

- Preventing Complications of Late-Onset Hypogonadism in American Men: Strategies and Insights [Last Updated On: March 21st, 2025] [Originally Added On: March 21st, 2025]

- Late-Onset Hypogonadism: Impact on Fertility and Health in American Men [Last Updated On: March 22nd, 2025] [Originally Added On: March 22nd, 2025]

- Exercise as a Key Strategy for Managing Late-Onset Hypogonadism in American Males [Last Updated On: March 22nd, 2025] [Originally Added On: March 22nd, 2025]

- Late-Onset Hypogonadism: Early Detection and Management in American Males [Last Updated On: March 22nd, 2025] [Originally Added On: March 22nd, 2025]

- Hormone Replacement Therapy for Late-Onset Hypogonadism: Benefits, Risks, and Guidelines [Last Updated On: March 22nd, 2025] [Originally Added On: March 22nd, 2025]

- Understanding and Managing Late-Onset Hypogonadism in American Men Over 40 [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Managing Late-Onset Hypogonadism: Emotional Challenges and Support for American Men [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Stress Exacerbates Late-Onset Hypogonadism in American Males: Management Strategies [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Understanding Late-Onset Hypogonadism: Impacts and Management in Aging Men [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Exploring the Link Between Late-Onset Hypogonadism and Diabetes in American Males [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Late-Onset Hypogonadism: Understanding Symptoms, Impacts, and Management Strategies for American Men [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Late-Onset Hypogonadism: Impact on Sleep and Holistic Management Strategies for American Men [Last Updated On: March 23rd, 2025] [Originally Added On: March 23rd, 2025]

- Late-Onset Hypogonadism's Cognitive Impact in American Men: Awareness and Management Strategies [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Late-Onset Hypogonadism: Understanding TRT Benefits and Risks in American Males [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Understanding Late-Onset Hypogonadism: Symptoms, Impact, and Management for American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Managing Late-Onset Hypogonadism: Symptoms, Diagnosis, and Treatment Options for American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Dietary Strategies to Manage Late-Onset Hypogonadism in American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Understanding Late-Onset Hypogonadism: Prevalence, Symptoms, and Management in American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Late-Onset Hypogonadism: Symptoms, Diagnosis, and Management in American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Late-Onset Hypogonadism: Prevalence, Risks, and Management in American Men [Last Updated On: March 24th, 2025] [Originally Added On: March 24th, 2025]

- Diagnosing Late-Onset Hypogonadism: Symptoms, Testing, and Challenges in American Men [Last Updated On: March 25th, 2025] [Originally Added On: March 25th, 2025]

- Late-Onset Hypogonadism: Overcoming Stigma and Enhancing Men's Health in America [Last Updated On: March 25th, 2025] [Originally Added On: March 25th, 2025]

- Understanding Late-Onset Hypogonadism: Symptoms, Impact, and Management for American Men [Last Updated On: March 25th, 2025] [Originally Added On: March 25th, 2025]

- Early Intervention Benefits for Late-Onset Hypogonadism in American Men [Last Updated On: March 25th, 2025] [Originally Added On: March 25th, 2025]

- Managing Late-Onset Hypogonadism: Symptoms, Diagnosis, and Treatment for American Men [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Late-Onset Hypogonadism in American Males: Importance of Monitoring and Management [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Managing Late-Onset Hypogonadism: A Multidisciplinary Approach for American Men [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Advocating for Better Late-Onset Hypogonadism Care: A Call to Action for American Men [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Late-Onset Hypogonadism: Understanding, Managing, and Maintaining Independence in American Men [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Advanced Technology Enhances LOH Diagnosis in American Males [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Managing Late-Onset Hypogonadism: Symptoms, Diagnosis, and Treatment for Aging Men [Last Updated On: March 26th, 2025] [Originally Added On: March 26th, 2025]

- Late-Onset Hypogonadism: Diagnosis, Treatments, and Lifestyle Management for American Men [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Understanding Late-Onset Hypogonadism: Symptoms, Diagnosis, and Treatment for American Men [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Late-Onset Hypogonadism: Impact on Intimate Relationships and Management Strategies [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Late-Onset Hypogonadism: Symptoms, Diagnosis, and Management Strategies for American Men [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Cultural Perceptions and Management of Late-Onset Hypogonadism in American Men [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Understanding Late-Onset Hypogonadism: Myths, Facts, and Management for American Men [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Legal Aspects of Late-Onset Hypogonadism: Diagnosis, Treatment, and Rights in the U.S. [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Holistic Treatment of Late-Onset Hypogonadism in American Males: A Comprehensive Approach [Last Updated On: March 27th, 2025] [Originally Added On: March 27th, 2025]

- Managing Late-Onset Hypogonadism: The Crucial Role of Mental Health Professionals [Last Updated On: March 28th, 2025] [Originally Added On: March 28th, 2025]

- Community Support Enhances Management of Late-Onset Hypogonadism in American Males [Last Updated On: March 28th, 2025] [Originally Added On: March 28th, 2025]

- Family Support Crucial for American Males with Late-Onset Hypogonadism [Last Updated On: March 28th, 2025] [Originally Added On: March 28th, 2025]

- Late-Onset Hypogonadism: Impacts and Strategies for Career Management in American Men [Last Updated On: March 28th, 2025] [Originally Added On: March 28th, 2025]

- Late-Onset Hypogonadism: Financial Implications and Management Strategies for American Men [Last Updated On: March 28th, 2025] [Originally Added On: March 28th, 2025]

- Late-Onset Hypogonadism: Impact on Self-Esteem and Treatment Options for American Men [Last Updated On: April 2nd, 2025] [Originally Added On: April 2nd, 2025]

- Peer Support Enhances Life Quality for American Males with Late-Onset Hypogonadism [Last Updated On: April 2nd, 2025] [Originally Added On: April 2nd, 2025]

- Managing Late-Onset Hypogonadism: Lifestyle Strategies for American Men's Health [Last Updated On: April 2nd, 2025] [Originally Added On: April 2nd, 2025]

- Understanding Late-Onset Hypogonadism: Symptoms, Treatment, and Lifestyle Management for American Males [Last Updated On: April 6th, 2025] [Originally Added On: April 6th, 2025]

- Research Advances in Late-Onset Hypogonadism: Diagnosis, Treatment, and Lifestyle Impact [Last Updated On: April 8th, 2025] [Originally Added On: April 8th, 2025]

- Late-Onset Hypogonadism: Symptoms, Social Impact, and Management in American Men [Last Updated On: April 8th, 2025] [Originally Added On: April 8th, 2025]

- Late-Onset Hypogonadism: Symptoms, Diagnosis, and Management in American Males [Last Updated On: April 9th, 2025] [Originally Added On: April 9th, 2025]

- Managing Late-Onset Hypogonadism: Strategies for Mental Health in American Men [Last Updated On: April 9th, 2025] [Originally Added On: April 9th, 2025]

- Managing Late-Onset Hypogonadism: Stress, Nutrition, and Holistic Approaches for American Men [Last Updated On: April 10th, 2025] [Originally Added On: April 10th, 2025]

- Late-Onset Hypogonadism in American Men: Advocacy and Personalized Care [Last Updated On: April 10th, 2025] [Originally Added On: April 10th, 2025]

- Nutritionists' Role in Managing Late-Onset Hypogonadism in American Males [Last Updated On: April 10th, 2025] [Originally Added On: April 10th, 2025]

- Exercise Strategies to Combat Late-Onset Hypogonadism in American Men [Last Updated On: April 11th, 2025] [Originally Added On: April 11th, 2025]

- Late-Onset Hypogonadism: Prevalence, Impact, and Management in American Men [Last Updated On: April 12th, 2025] [Originally Added On: April 12th, 2025]

- Managing Late-Onset Hypogonadism: Symptoms, Diagnosis, and Treatment for American Men [Last Updated On: April 12th, 2025] [Originally Added On: April 12th, 2025]

- Late-Onset Hypogonadism: Understanding and Managing Emotional Impacts in Men Over 40 [Last Updated On: April 14th, 2025] [Originally Added On: April 14th, 2025]

Word Count: 586